The Trust’s mandate requires both the maintenance of a balance of assets sufficient to cover the effects of inflation since 1993 and the creation of annual cash income inflows which go out of the Trust by way of distribution to its beneficiary organizations. As part of their governance practices, Trustees annually review the assessment of the Trust’s progress in these two areas and always consider their mandate when considering any amendments to their investment strategy.

The Trust’s staff regularly monitors the progress of the Trust’s asset growth and compares the actual asset value with the assets that should be on hand based on calculations derived from its mandate (“mandated assets”) as laid out in its Trust Deed. Mandated asset balances are based on growing the value of the Net Settlement Payments by actual annual inflation rates.

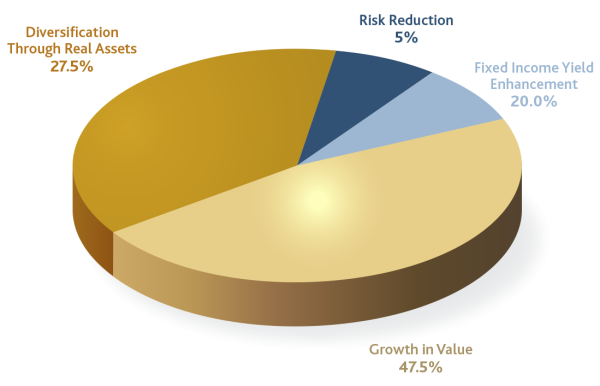

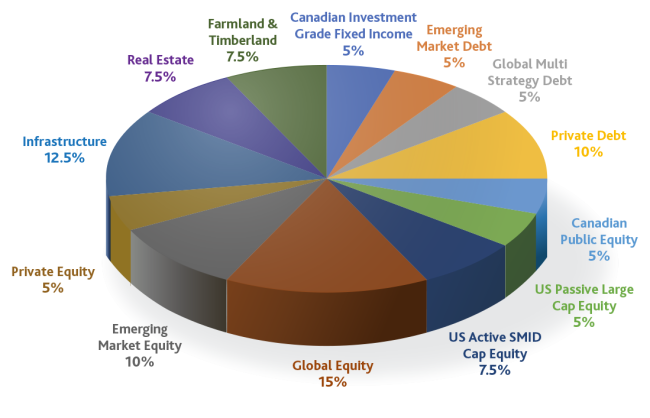

When all of the income available for distribution as determined by Canadian tax rules is paid out every year, a Trust Deed requirement, then the only way the Trust assets can grow with inflation is by investing in assets which increase in value over time and are eventually sold for a profit. These growth assets are intended to experience value appreciation over a period of time rather than to generate annual cash income. It is the realized cash income that the Trust distributes, that is approximated by the 4% payout amount, and that provides for the majority of the Trust’s beneficiary organizations’ operating budgets. Maintaining a stable, secure, slowly increasing distribution is extremely important to the Trustees.

When investment markets result in annual distributions falling short of the current 4% payout amount, assuming the beneficiary organizations draw the full amount of the 4%, the difference is advanced to beneficiary organizations as a capital loan. This ensures that beneficiary organizations have stability around the amount of funding they will receive each year. The existence of a capital loan balance makes it more challenging for the Trust to meet its mandated asset amount as those assets are not inside the Trust earning the Trust return. It is excess distributions that form the only meaningful way that capital loans can be repaid and the ability to generate distributions in excess of the 4% amount in the future depends heavily on future investment markets and world economic conditions, neither of which can be guaranteed to produce the Trust’s required returns.

In the early years of the Trust’s life, there were not enough assets inside the Trust to support the growing operating needs of its beneficiary organizations and this led to the accumulation of meaningful capital loans outstanding. Since 2012 the Trust has enjoyed strong investment markets and implemented a new investment strategy that stabilized returns and generated the necessary yearly cash to cover its cash outflows. These factors allowed the Trust to periodically generate distributions in excess of the 4% amount over the years since 2012 and thereby trigger repayments of those capital loans. All these original capital loans had been repaid by the end of 2018 through a combination of our main beneficiary organization taking less than the 4% payout amount and the Trust generating excess distributions.

Having those assets back inside the Trust has removed a historical roadblock to the ability of the Trust to achieve its mandate. Going forward it is key that the Trust’s investment strategy minimizes the need for capital loans outstanding for extended periods of time. Since 2013 the Trust has accumulated sufficient assets to cover its mandate with a reasonable additional reserve to offset any future investment market challenges and has generated sufficient annual income to cover and slowly increase its 4% payout amount. By having sufficient assets inside the Trust, a well-researched investment strategy and strong governance practices, the Trustees can continue to achieve the mandate which helps fund the missions of its beneficiary organizations.